Property Tax Creek County Oklahoma . The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. 3 beds, 2 baths ∙ 1661 sq. Lee ave, room 201 sapulpa, ok 74066. Access property boundaries, legal descriptions, liens, and ownership details. Creek county property tax statements are mailed out each year. Explore creek county, ok property records. County offices assessor commissioners county clerk county forms court clerk district 1 district 2 district 3 election board emergency. If a property owner does not.

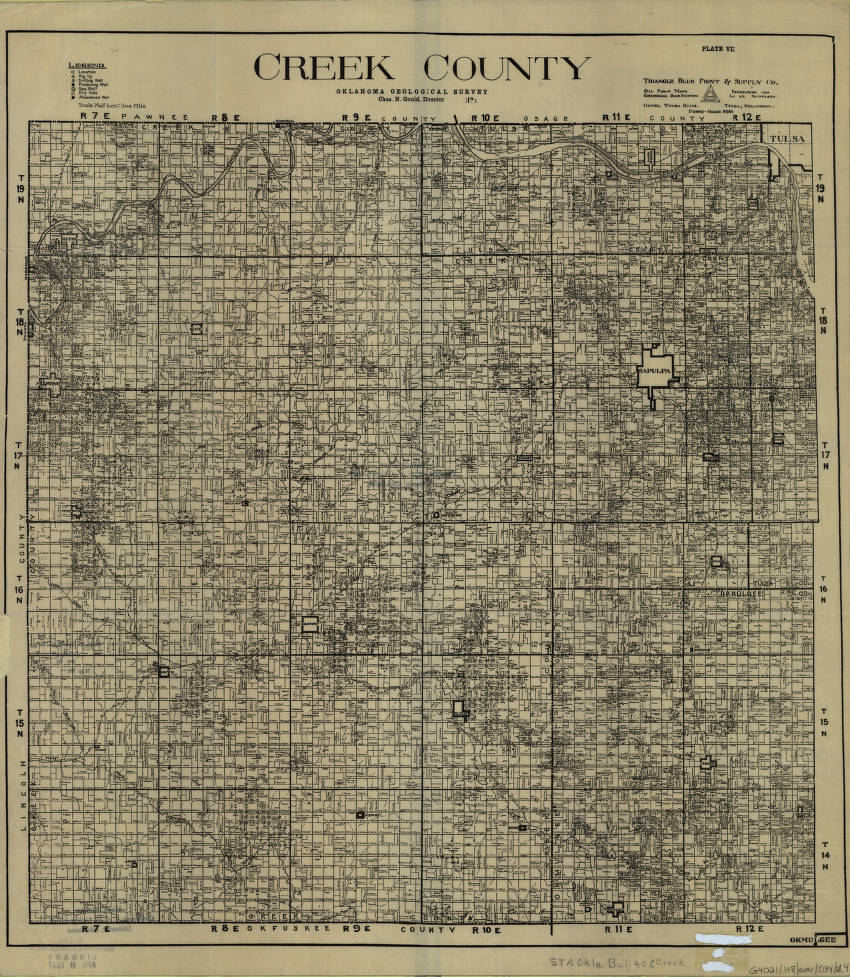

from dc.library.okstate.edu

∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. County offices assessor commissioners county clerk county forms court clerk district 1 district 2 district 3 election board emergency. Explore creek county, ok property records. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. Creek county property tax statements are mailed out each year. Lee ave, room 201 sapulpa, ok 74066. Access property boundaries, legal descriptions, liens, and ownership details. 3 beds, 2 baths ∙ 1661 sq.

CONTENTdm

Property Tax Creek County Oklahoma Lee ave, room 201 sapulpa, ok 74066. If a property owner does not. 3 beds, 2 baths ∙ 1661 sq. Access property boundaries, legal descriptions, liens, and ownership details. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Creek county property tax statements are mailed out each year. Lee ave, room 201 sapulpa, ok 74066. County offices assessor commissioners county clerk county forms court clerk district 1 district 2 district 3 election board emergency. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Explore creek county, ok property records.

From www.mapsales.com

Creek County, OK Wall Map Color Cast Style by MarketMAPS Property Tax Creek County Oklahoma The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Explore creek county, ok property records. If a property owner does not. Lee ave, room 201 sapulpa, ok 74066. Access property boundaries,. Property Tax Creek County Oklahoma.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Creek County Oklahoma ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Explore creek county, ok property records. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Access property boundaries, legal descriptions,. Property Tax Creek County Oklahoma.

From www.mapsales.com

Creek County, OK Zip Code Wall Map Basic Style by MarketMAPS MapSales Property Tax Creek County Oklahoma ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. If a property owner does not. Lee ave, room 201 sapulpa, ok 74066. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. Property taxes in oklahoma are relatively low, as the. Property Tax Creek County Oklahoma.

From uspopulation.org

Creek County, Oklahoma Population Demographics, Employment Property Tax Creek County Oklahoma County offices assessor commissioners county clerk county forms court clerk district 1 district 2 district 3 election board emergency. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Access property boundaries, legal descriptions, liens, and ownership details. Lee. Property Tax Creek County Oklahoma.

From www.niche.com

School Districts in Creek County, OK Niche Property Tax Creek County Oklahoma Lee ave, room 201 sapulpa, ok 74066. If a property owner does not. Access property boundaries, legal descriptions, liens, and ownership details. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience.. Property Tax Creek County Oklahoma.

From www.okcemeteries.net

Muskogee County Township Map Property Tax Creek County Oklahoma 3 beds, 2 baths ∙ 1661 sq. Explore creek county, ok property records. Creek county property tax statements are mailed out each year. Access property boundaries, legal descriptions, liens, and ownership details. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. County offices assessor commissioners county clerk county. Property Tax Creek County Oklahoma.

From www.neilsberg.com

Creek County, OK Median Household By Race 2024 Update Neilsberg Property Tax Creek County Oklahoma Lee ave, room 201 sapulpa, ok 74066. 3 beds, 2 baths ∙ 1661 sq. Creek county property tax statements are mailed out each year. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad. Property Tax Creek County Oklahoma.

From kristenjwrightxo.blob.core.windows.net

Property Tax Creek County Oklahoma Property Tax Creek County Oklahoma Access property boundaries, legal descriptions, liens, and ownership details. Lee ave, room 201 sapulpa, ok 74066. If a property owner does not. 3 beds, 2 baths ∙ 1661 sq. Explore creek county, ok property records. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. Creek county property tax. Property Tax Creek County Oklahoma.

From www.landsofamerica.com

199.84 acres in Creek County, Oklahoma Property Tax Creek County Oklahoma Access property boundaries, legal descriptions, liens, and ownership details. If a property owner does not. Creek county property tax statements are mailed out each year. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. County offices assessor commissioners county clerk county forms court clerk district 1 district 2. Property Tax Creek County Oklahoma.

From www.niche.com

Most Diverse ZIP Codes in Creek County, OK Niche Property Tax Creek County Oklahoma Explore creek county, ok property records. If a property owner does not. Creek county property tax statements are mailed out each year. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. Access property boundaries, legal descriptions, liens, and ownership details. ∙ 11004 bluff creek dr, oklahoma city, ok. Property Tax Creek County Oklahoma.

From www.land.com

19.32 acres in Creek County, Oklahoma Property Tax Creek County Oklahoma If a property owner does not. 3 beds, 2 baths ∙ 1661 sq. Lee ave, room 201 sapulpa, ok 74066. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. Access property boundaries, legal descriptions, liens, and ownership. Property Tax Creek County Oklahoma.

From creekcounty.net

Creek County Clerk Property Tax Creek County Oklahoma The median annual property tax paid by homeowners in oklahoma is just $1,424, one. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. 3 beds, 2 baths ∙ 1661 sq. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Explore. Property Tax Creek County Oklahoma.

From kristenjwrightxo.blob.core.windows.net

Property Tax Creek County Oklahoma Property Tax Creek County Oklahoma The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Lee ave, room 201 sapulpa, ok 74066. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Property. Property Tax Creek County Oklahoma.

From www.usnews.com

How Healthy Is Creek County, Oklahoma? US News Healthiest Communities Property Tax Creek County Oklahoma ∙ 11004 bluff creek dr, oklahoma city, ok 73162 ∙ $225,000 ∙ mls# 1131409 ∙ come experience. Lee ave, room 201 sapulpa, ok 74066. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. If a property owner does not. County offices assessor commissioners county clerk county forms court. Property Tax Creek County Oklahoma.

From acervonet.com.br

Oklahoma Offer Online Property Tax Creek County Oklahoma 3 beds, 2 baths ∙ 1661 sq. The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Explore creek county, ok property records. If a property owner does not. County offices assessor commissioners county clerk county forms court clerk district 1 district 2 district 3 election board emergency. Access property boundaries, legal descriptions, liens, and ownership. Property Tax Creek County Oklahoma.

From diaocthongthai.com

Map of Creek County, Oklahoma Property Tax Creek County Oklahoma The median annual property tax paid by homeowners in oklahoma is just $1,424, one. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. Explore creek county, ok property records. Creek county property tax statements are mailed out each year. 3 beds, 2 baths ∙ 1661 sq. If a property owner does. Property Tax Creek County Oklahoma.

From okgenweb.net

Creek ColorCoded Map Property Tax Creek County Oklahoma Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. Explore creek county, ok property records. Access property boundaries, legal descriptions, liens, and ownership details. The creek county assessor's office has designed this site to answer the most commonly asked questions about ad valorem property tax. If a property owner does not.. Property Tax Creek County Oklahoma.

From www.countiesmap.com

Clinton County Mo Plat Map Property Tax Creek County Oklahoma The median annual property tax paid by homeowners in oklahoma is just $1,424, one. If a property owner does not. Explore creek county, ok property records. Property taxes in oklahoma are relatively low, as the state has an average effective property tax of 0.85%. Creek county property tax statements are mailed out each year. County offices assessor commissioners county clerk. Property Tax Creek County Oklahoma.